Day trading is one of the most exciting and fast-paced ways to participate in the stock market. Unlike long-term investing, day trading involves buying and selling stocks within the same day to capitalize on short-term price movements. While it can be highly profitable, it also comes with significant risks. To succeed as a day trader, you need a solid understanding of the market, disciplined execution, and effective day trading strategies. In this article, we’ll explore some of the best strategies for day trading success and provide tips to help you navigate this challenging but rewarding endeavor.

What is Day Trading?

Day trading is the practice of buying and selling stocks, options, or other securities within a single trading day. The goal is to profit from short-term price fluctuations, often leveraging technical analysis and market trends. Day traders typically close all their positions before the market closes to avoid overnight risk. This approach requires quick decision-making, a deep understanding of market dynamics, and the ability to manage risk effectively.

While day trading can be lucrative, it’s not for everyone. It requires a significant time commitment, emotional discipline, and a willingness to accept the possibility of losses. However, with the right strategies and mindset, you can increase your chances of success.

Top Day Trading Strategies

Here are some of the most effective day trading strategies used by successful traders:

1. Momentum Trading

Momentum trading involves identifying stocks that are moving significantly in one direction with high volume. Traders look for stocks that are breaking out of a price range or experiencing a surge in volume due to news or earnings reports. The idea is to ride the momentum until it starts to fade, then exit the trade with a profit.

Key Tips:

- Use technical indicators like Relative Strength Index (RSI) and Moving Averages to confirm momentum.

- Set strict stop-loss orders to limit potential losses if the trade goes against you.

- Focus on stocks with high liquidity to ensure you can enter and exit positions easily.

2. Scalping

Scalping is a strategy that involves making dozens or even hundreds of trades in a single day to capture small price movements. Scalpers aim to profit from minor fluctuations in stock prices, often holding positions for just a few seconds or minutes. This strategy requires precision, speed, and a reliable trading platform.

Key Tips:

- Focus on highly liquid stocks with tight bid-ask spreads.

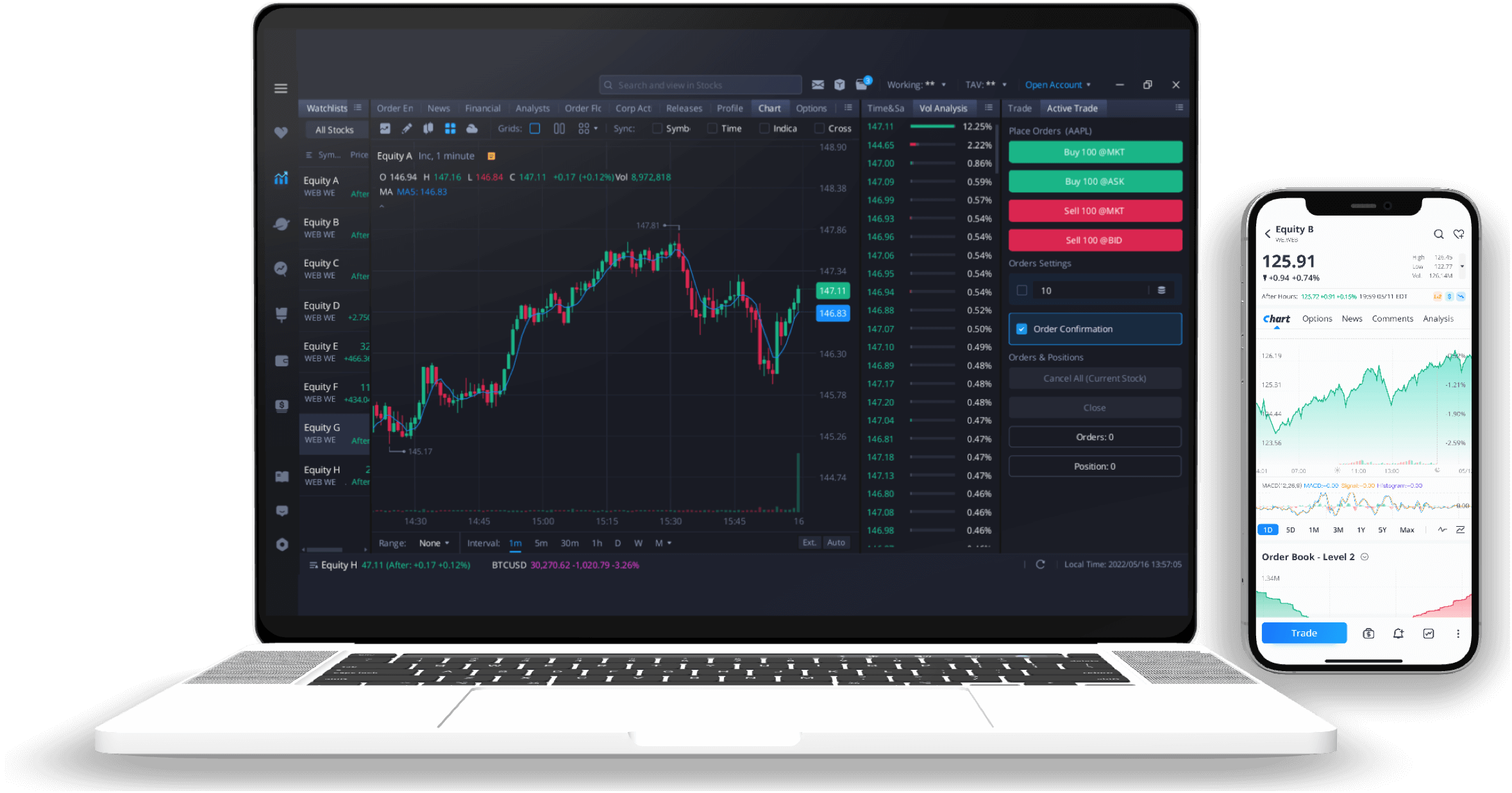

- Use Level 2 data to monitor order flow and identify entry and exit points.

- Keep transaction costs low, as frequent trading can eat into profits.

3. Breakout Trading

Breakout trading involves identifying key levels of support or resistance and entering a trade when the price breaks through these levels. Breakouts often occur after a period of consolidation and can lead to significant price movements. Traders use chart patterns, such as triangles and rectangles, to identify potential breakout opportunities.

Key Tips:

- Wait for confirmation of the breakout before entering a trade to avoid false breakouts.

- Set stop-loss orders just below the breakout level to minimize risk.

- Use volume as a confirmation tool—breakouts with high volume are more likely to succeed.

4. Reversal Trading

Reversal trading, also known as contrarian trading, involves identifying stocks that are overbought or oversold and anticipating a reversal in price direction. Traders use technical indicators like RSI, Bollinger Bands, and MACD to spot potential reversals. This strategy can be highly profitable if timed correctly but carries the risk of catching a "falling knife."

Key Tips:

- Look for divergence between price and indicators as a sign of a potential reversal.

- Use candlestick patterns, such as doji or engulfing patterns, to confirm reversals.

- Set tight stop-loss orders to limit losses if the reversal doesn’t materialize.

Essential Tools for Day Traders

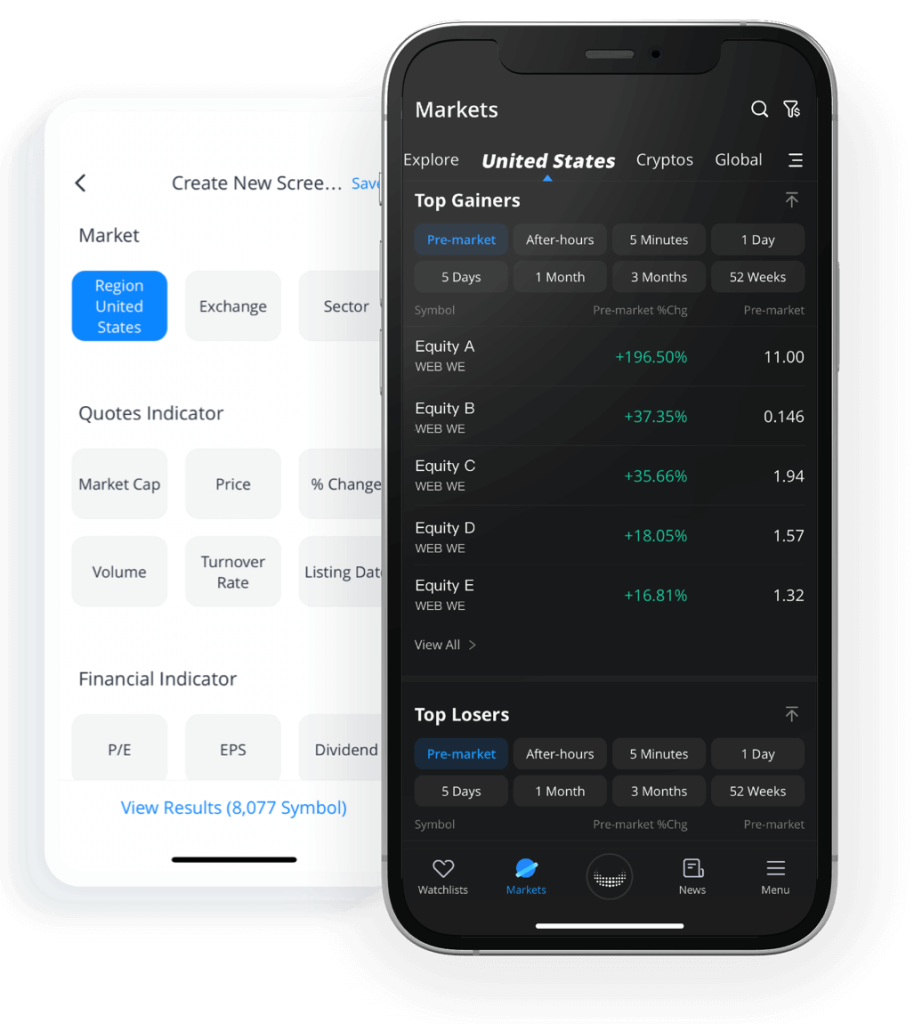

To execute these strategies effectively, you’ll need the right tools and resources. Here are some essentials for every day trader:

- Real-Time Data: Access to real-time market data is crucial for making informed decisions. Consider subscribing to a reliable data feed.

- Technical Analysis Software: Use charting platforms like TradingView or Thinkorswim to analyze price movements and identify trading opportunities.

- Level 2 Quotes: Level 2 data provides insight into the order book, helping you gauge supply and demand for a stock.

- News Sources: Stay updated on market-moving news with platforms like Bloomberg, CNBC, or Reuters.

Risk Management Tips for Day Traders

Risk management is critical for day traders, as the potential for losses is high. Here are some tips to protect your capital:

- Set Stop-Loss Orders: Always define your risk before entering a trade by setting a stop-loss order. This limits your losses if the trade goes against you.

- Risk-Reward Ratio: Aim for a favorable risk-reward ratio, such as 1:2 or 1:3, to ensure your potential profits outweigh your potential losses.

- Position Sizing: Avoid risking more than 1-2% of your trading capital on a single trade. This helps preserve your capital during losing streaks.

- Avoid Overtrading: Stick to your trading plan and avoid the temptation to chase trades. Quality over quantity is key.

Common Mistakes to Avoid

Even experienced traders can make mistakes. Here are some common pitfalls to watch out for:

- Lack of a Plan: Trading without a clear plan is a recipe for disaster. Always define your entry, exit, and risk management strategies before entering a trade.

- Emotional Trading: Letting emotions like fear and greed dictate your decisions can lead to costly mistakes. Stay disciplined and stick to your strategy.

- Ignoring Market Conditions: Not all strategies work in all market conditions. Adapt your approach based on whether the market is trending, ranging, or volatile.

- Neglecting stock market research: Failing to stay informed about market trends, news, and economic data can put you at a disadvantage.

Final Thoughts

Day trading offers the potential for significant profits, but it requires skill, discipline, and a well-thought-out strategy. By mastering proven day trading strategies, using the right tools, and practicing effective risk management, you can increase your chances of success in this competitive field.

Remember, day trading is not a get-rich-quick scheme. It takes time, effort, and continuous learning to become a consistently profitable trader. Stay focused, keep refining your skills, and always prioritize risk management. With dedication and the right approach, you can achieve your day trading goals and thrive in the stock market.