The NASDAQ is home to some of the most innovative and high-growth companies in the world. As we look ahead to 2025, identifying the top NASDAQ stocks to watch can help you capitalize on emerging trends and position your portfolio for long-term success. Whether you're a growth-oriented investor or someone looking for stability with upside potential, this guide will highlight key stocks and sectors that could dominate the market in the coming years.

Why Focus on NASDAQ Stocks?

The NASDAQ Composite is known for its heavy weighting in technology and growth-oriented companies. Unlike other indices, the NASDAQ is a hub for innovation, featuring leaders in sectors like artificial intelligence, cloud computing, biotechnology, and renewable energy. Investing in NASDAQ stocks offers exposure to companies that are shaping the future, making it an attractive option for investors seeking high returns.

However, it's important to remember that growth stocks can be volatile. While they offer significant upside potential, they also come with higher risks. A well-researched approach and a focus on quality companies can help you navigate these challenges and build a robust portfolio.

Key Trends Shaping the NASDAQ in 2025

To identify the top stocks to watch, it's essential to understand the trends that will drive the NASDAQ in 2025. Here are some of the most impactful trends:

- Artificial Intelligence (AI): AI is transforming industries, from healthcare to finance. Companies leading in AI development and implementation are poised for significant growth.

- Cloud Computing: The shift to cloud-based solutions continues to accelerate, with businesses and consumers relying on cloud services for storage, software, and more.

- Biotechnology: Advances in gene editing, personalized medicine, and drug development are creating opportunities for biotech companies.

- Renewable Energy: As the world transitions to cleaner energy sources, companies in solar, wind, and electric vehicles are gaining momentum.

- E-commerce and Digital Payments: The rise of online shopping and cashless transactions is reshaping the retail and financial sectors.

Top NASDAQ Stocks to Watch in 2025

Based on these trends, here are some of the top NASDAQ stocks that could deliver strong performance in 2025:

1. NVIDIA Corporation (NVDA)

NVIDIA is a leader in AI, graphics processing units (GPUs), and data center solutions. The company’s technology is at the forefront of AI development, powering everything from autonomous vehicles to deep learning algorithms. With the AI revolution in full swing, NVIDIA is well-positioned for continued growth.

Why Watch:

- Dominance in GPU and AI markets.

- Expansion into data centers and autonomous driving.

- Strong revenue growth and profitability.

2. Microsoft Corporation (MSFT)

Microsoft is a tech giant with a diverse portfolio, including cloud computing (Azure), software (Office, Windows), and gaming (Xbox). The company’s focus on AI integration across its products and services makes it a key player in the tech landscape.

Why Watch:

- Leadership in cloud computing with Azure.

- Growing adoption of AI-powered tools like Copilot.

- Consistent revenue and dividend growth.

3. Tesla, Inc. (TSLA)

Tesla remains a dominant force in the electric vehicle (EV) market, with a growing presence in energy storage and solar solutions. As the world shifts toward renewable energy, Tesla’s innovative approach and brand strength give it a competitive edge.

Why Watch:

- Expanding EV production and global market share.

- Growth in energy storage and solar businesses.

- Potential for breakthroughs in autonomous driving.

4. Moderna, Inc. (MRNA)

Moderna is a biotechnology company known for its mRNA technology, which was instrumental in developing COVID-19 vaccines. The company is now applying this technology to other diseases, including cancer and rare genetic disorders.

Why Watch:

- Pioneering mRNA technology with broad applications.

- Strong pipeline of vaccines and therapeutics.

- Potential for long-term growth in biotech.

5. Amazon.com, Inc. (AMZN)

Amazon is a leader in e-commerce and cloud computing (Amazon Web Services). The company continues to innovate in areas like logistics, AI, and digital advertising, making it a versatile player in the tech and retail sectors.

Why Watch:

- Dominance in e-commerce and cloud computing.

- Expansion into new markets like healthcare and entertainment.

- Strong cash flow and reinvestment in growth initiatives.

Investment Strategies for NASDAQ Stocks

Investing in NASDAQ stocks requires a strategic approach to maximize returns and manage risks. Here are some strategies to consider:

1. Focus on Growth Stocks

Growth stocks are companies expected to grow at an above-average rate compared to the market. These stocks often reinvest earnings into expansion rather than paying dividends, making them ideal for long-term capital appreciation. Look for companies with strong revenue growth, innovative products, and a competitive edge.

2. Diversify Across Sectors

While the NASDAQ is tech-heavy, it’s important to diversify across sectors to reduce risk. Consider including stocks from healthcare, consumer goods, and renewable energy to balance your portfolio.

3. Use Dollar-Cost Averaging

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy helps reduce the impact of volatility and lowers the average cost per share over time.

4. Monitor Market Trends

Stay informed about stock market performance and emerging trends. Regularly review earnings reports, industry news, and economic indicators to make informed decisions.

Risks to Consider

While NASDAQ stocks offer significant growth potential, they also come with risks. Here are some key considerations:

- Volatility: Growth stocks can experience sharp price swings, especially during market downturns.

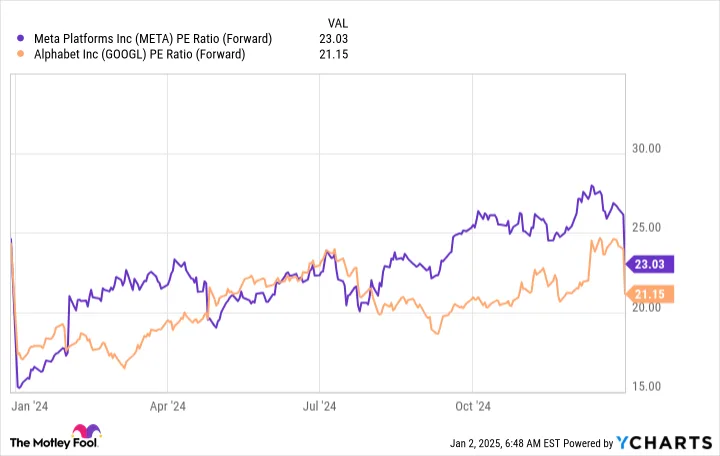

- Valuation Concerns: Some high-growth stocks may be overvalued, increasing the risk of a price correction.

- Regulatory Risks: Tech companies, in particular, face scrutiny from regulators, which could impact their operations and profitability.

Final Thoughts

As we approach 2025, the NASDAQ remains a hotbed of innovation and growth. By focusing on top-performing NASDAQ stocks and adopting sound investment strategies, you can position your portfolio for long-term success. Remember to stay informed, diversify your investments, and manage risks effectively to navigate the dynamic world of growth stocks.

Whether you're a seasoned investor or just starting out, the NASDAQ offers a wealth of opportunities to capitalize on the trends shaping the future. With careful research and a disciplined approach, you can unlock the potential of these high-growth companies and achieve your financial goals.